Swiss VAT Calculator

Calculate prices including or excluding VAT using the current VAT rates in Switzerland

How VAT Works in Switzerland: Your Complete Guide!

VAT (Value Added Tax) affects both businesses and individuals. Understanding how to calculate Swiss VAT will help you set your selling prices accurately. Our Swiss VAT calculator makes it easy!

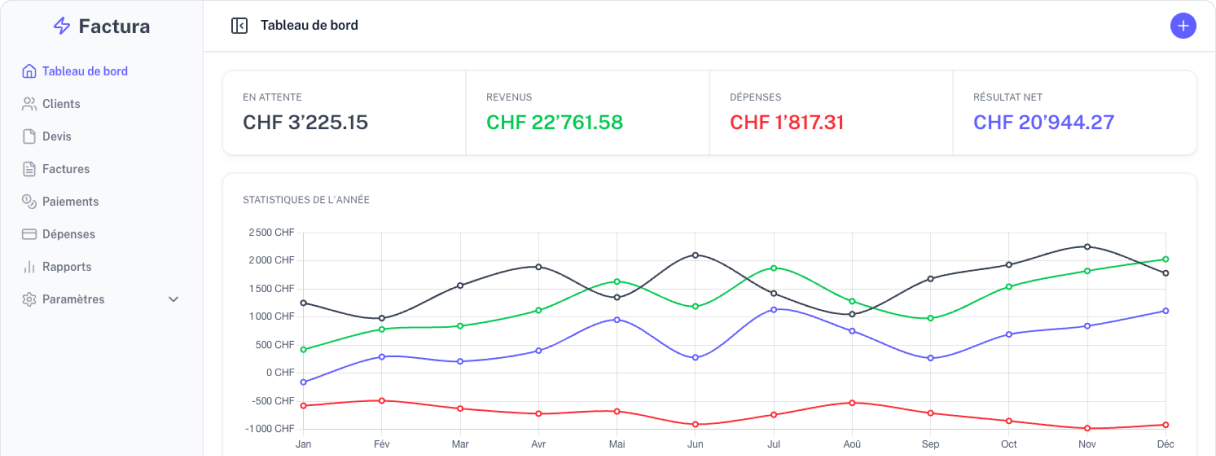

Are you self-employed or a freelancer? Create your invoices with Factura in just a few clicks and get a VAT collection report.

How to Calculate Swiss VAT: Excluding and Including Tax Methods

There are two ways to calculate VAT in Switzerland, either from the amount excluding tax or including all taxes:

Calculating the Amount Including Tax from Excluding Tax

Calculating the Amount Excluding Tax from Including Tax

Our Swiss VAT calculator automates these calculations, eliminating the risk of errors and saving you valuable time!

Current VAT Rates

New VAT rates have been in effect since January 1, 2024, following the implementation of the AVS 21 reform. The applicable rate depends on the type of goods or services:

Why is Accurate VAT Calculation Crucial?

Legal Compliance

The Federal Tax Administration (FTA) requires accurate reporting. Errors lead to corrections, late payment interest, and fines that can reach several thousand francs.

Professional Invoicing

Invoices with correct VAT strengthen your credibility and avoid disputes with your clients.

Financial Optimization

Precise calculation allows you to optimize your cash flow, maximize your input tax deductions, and improve your profitability.

Price Transparency

Understanding VAT helps consumers better analyze prices and businesses better justify their rates.

Practical Examples of Swiss VAT Calculation

Here's how to calculate VAT with concrete examples:

Situation: service billed CHF 750 excluding tax (standard rate 8.1%)

VAT = CHF 750 × 0.081 = CHF 60.75

Price including tax = CHF 750 + CHF 60.75 = CHF 810.75

Situation: book purchased CHF 45.20 including tax (reduced rate 2.6%)

Price excluding tax = CHF 45.20 ÷ 1.026 = CHF 44.06

VAT = CHF 45.20 - CHF 44.06 = CHF 1.14

Situation: room with breakfast CHF 180 excluding tax (special rate 3.8%)

VAT = CHF 180 × 0.038 = CHF 6.84

Total including tax = CHF 180 + CHF 6.84 = CHF 186.84

These calculations can be verified with our VAT calculator at the top of the page.

Who is Subject to VAT in Switzerland?

Being subject to Swiss VAT mainly depends on your annual turnover:

- Commercial businesses: ≥ CHF 100,000

- Sports/cultural associations: ≥ CHF 250,000

- Public utility institutions: ≥ CHF 250,000

Voluntary registration is possible even below these thresholds.

Frequently Asked Questions about VAT in Switzerland

A VAT-inclusive (inc VAT) price is an amount that includes VAT. It is calculated by adding VAT to the price excluding VAT (ex VAT).

A VAT-exclusive (ex VAT) price is an amount that does not include VAT. It can be calculated by subtracting VAT from the VAT-inclusive price (inc VAT).

The VAT increase in Switzerland, which took effect on January 1, 2024, was primarily driven by the need to fund the AVS (Old-Age and Survivors' Insurance), Switzerland's pension system. This increase was approved in a popular vote on September 25, 2022, when Swiss voters accepted the "AVS 21" reform. The reform aims to ensure the long-term financial sustainability of the AVS in response to an aging population and growing pension funding requirements.

The reform includes raising the retirement age for women from 64 to 65 and, to complete the funding package, increasing VAT rates. The new rates in effect since 2024 are:

- Standard rate: from 7.7% to 8.1%

- Reduced rate: from 2.5% to 2.6%

- Special rate (accommodation): from 3.7% to 3.8%

This increase aims to stabilize AVS funding, a cornerstone of Switzerland's social system, and adapt the tax system to the country's demographic and economic changes.

Since January 1, 2024, the VAT rates in Switzerland are:

-

Standard rate: 8.1%

Applies to most goods and services sold in Switzerland. -

Reduced rate: 2.6%

Applies primarily to food, books, medicine, and certain essential goods. -

Special rate (accommodation): 3.8%

Applies to accommodation services, such as hotel stays (excluding meals and beverages).

VAT (Value Added Tax) in Switzerland is an indirect consumption tax collected by businesses from consumers and remitted to the Confederation (the Swiss federal government). It is a major source of federal revenue and funds a significant portion of public expenditure.

VAT primarily funds the Confederation's general expenditures, including:

- Public infrastructure (roads, transportation, etc.)

- Education

- Healthcare

- Security

- Other essential public services

For example, in 2005, VAT generated over 18 billion francs for the government, covering more than one-third of the Confederation's total expenditure that year. This illustrates VAT's central role in funding the Swiss government.

VAT is charged at each stage of the production and distribution chain, but is ultimately paid by the end consumer.

Businesses deduct the VAT they paid on business purchases from the VAT they collect on sales, remitting the difference to the government (input tax deduction system).

- Copyright © 2026 - All rights reserved

- Made in Switzerland 🇨🇭 by Kevin

- Hosted by Infomaniak in the most ecological datacenter in Switzerland